nebraska transfer tax calculator

We would like to show you a description here but the site wont allow us. As a first-time home buyer you would only have to pay a 75 transfer tax for a home price of up to 400000.

New York Hourly Paycheck Calculator Gusto

The average effective property tax rate in Nebraska is 161 which ranks among the 10 most burdensome states in the country when it comes to real estate taxes.

. When you sell your home youre generally required to pay. Nebraska Income Tax Calculator 2021. For example in Michigan state transfer taxes are levied at a.

The Federal or IRS Taxes Are Listed. This tax is known as the Documentary Stamp Tax and is based upon the value of the real property being transferred. You would then have a cost basis of 104000 and can use this to calculate your capital gain cost.

That means they are taxed at. Our calculator has recently been updated to. Long-term and short-term capital gains are included as regular income on your Nebraska income tax return.

- Nebraska State Tax. Its a progressive system which means that taxpayers who earn more pay higher taxes. Your average tax rate is 1198 and your marginal.

There are four tax brackets in. If you make 70000 a year living in the region of nebraska usa you will be taxed 12680. In counties containing a city of the metropolitan class 18 is allocated to the county and 22 to the city or village.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Just enter the wages tax withholdings and other information required. Use ADPs Nebraska Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Diversity statement on resume Registration Fees and Taxes Nebraska Department of Motor. If you make 70000 a year living in the region of Nebraska USA you will be taxed 12680. On any amount above 400000 you would have to pay the full 2.

You pay 4000 in transfer taxes. The total amount taxed is based on the value of the property. If you need to find your propertys most recent tax assessment or the actual property tax due on your property.

If you make 100000 a year living in the region of Nebraska USA you will be taxed 21353. For comparison the median home value in Nebraska is. The State of Delaware transfer tax rate is 250.

Average local state. You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. Your average tax rate is 1501 and your marginal.

Nebraska Documentary Stamp Tax Computation Table Consideration or Market Value Tax Consideration or Market Value Tax Consideration or Market Value Tax. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Nebraska Transfer Tax Calculator.

The tax is due at the time the deed transferring the interest in real. Nebraskas state income tax system is similar to the federal system. For comparison the median home value in Douglas County is 14140000.

100 rows Nebraska Capital Gains Tax. Nebraska Income Tax Calculator 2021. Nebraska has a 55 statewide sales tax rate but.

If the tax district is not in a city or village 40 is allocated to the county and. The Nebraska Tax Estimator Lets You Calculate Your State Taxes For the Tax Year.

Don T Die In Nebraska How The County Inheritance Tax Works

Seller Closing Costs In Nebraska Closing Cost Calculator Houzeo

Property Tax Calculator Smartasset

How To Set Up An Llc In Nebraska 2022 Guide Forbes Advisor

Capital Gains Tax Calculator Estimate What You Ll Owe

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Nebraska Legislature 2020 Early Childhood Policy Highlights First Five Nebraska

Where S My Refund Nebraska H R Block

Taxes And Spending In Nebraska

Transfer Tax In Marin County California Who Pays What

Probate In Nebraska Archives Boyum Law

Nebraska Estate Tax Everything You Need To Know Smartasset

Nebraska Mortgage Rates Today S Ne Mortgage Refinance Rates

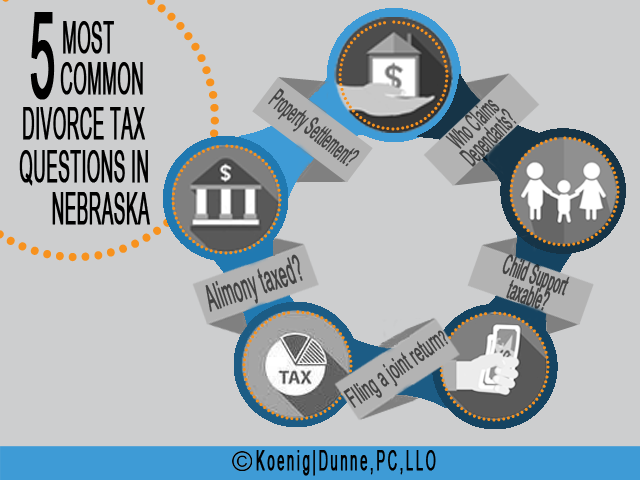

Divorce Tax Tips 5 Most Common Divorce Tax Questions In Nebraska Koenig Dunne

Roth Conversion Calculator Nebraska Energy Federal Credit Union